What is Market Structure?

Market structure is a price movement pattern in each time frame to analyze price highs or lows and give traders a sight to map their positions into the markets. Market structure provides traders a direction of ongoing price movement in any particular market.

Why Does Market Structure Matters?

This is the first gauge for any trader to predict the market movement called Trends. It’s saying in the market “ Trend is your friend so go with it “. A trader needs to train eyes to see which side the market is going either upside BULLISH MARKET , down side BEARISH MARKET , or side way CHOPPY OR CONSOLIDATION.

Hint : A trader who flows with trends is a more successful trader.

If you want to know exactly when the London, New York, Tokyo, and Sydney sessions open in your local time, this Forex Market Hours tool makes it simple and accurate.

Basic Market Structure Explained:

UP TREND BULLISH MARKET:

When prices are moving upward, it is called the BULLISH market. It indicates buyers are strong at the movement. Prices neither go directly upwards instead go by creating Higher Highs and Higher lows in an upward trend. Price creates swing highs and swing lows for expansion or creating price legs.

DOWN TREND BEARISH MARKET:

In contrast to a bullish market , a bearish market is a downward trend which indicates the sellers are dominating the prices at the movement. Prices expand legs by creating lower highs and lower lows. This is a bearish trend. Price creates swing highs and swing lows for expansion or creating price legs.

SIDEWAYS MARKET STRUCTURE (CHOPPY) :

In this scenario prices trade between defined ranges , without expanding highs or lows instead creating highs and lows at the same level.

Proper risk management starts with position sizing. This Position Size Calculator helps you calculate the exact lot size based on your risk percentage and stop loss.

Hint : We should always avoid these markets to prevent our loss or protect our capital

Why is Break of Structure Important for Trend Identification?

When price expands either upside or downside it expands by breaking its swings points upside or downside according to an ongoing trend. BOS is breaking the structure refers , when price breaks its swing high or old swing high after taking a retracement or inducement ( the nearest liquidity point to swing high or low) and expands further in ongoing trend or direction it’s shows the intention of price to make another swing high or low according to ongoing trend. This previously made swing break is called a break of structure.

Hint : Traders can take a position after the break of structure but wait for the price to retrace back.

What is Order Flow and Why Does it Move the Market?

An order flow is an expansion of price legs in an uptrend or downtrend. When prices are in a trend usually the structure expands further by creating highs and lows.Order flow indicates the real time buying and selling in markets. Order flow shows the aggression of buyers and sellers in a particular market.

ORDER FLOW LEG:

If a price is flowing in a strong trend up side or down side the order flow expands by generating the order flow legs. These are the sweet spots to enter from , in order to trade the ongoing trends. Order flow leg contains three things

- Swing high

- Fair value gap

- Swing low

Before placing any trade, it’s important to understand currency values. This Currency Converter lets you quickly convert currencies using live exchange rates.

An order flow leg are the signs the trend is still continuing to go and we need to enter into a trend most favourable from a fair value gap inside the order flow leg.

ADVANCE MARKET STRUCTURE

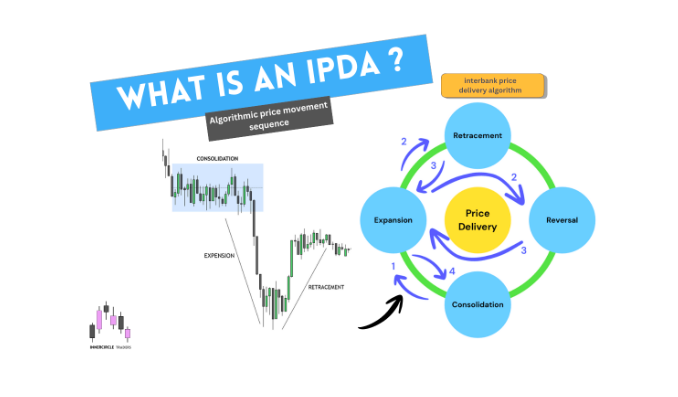

ICT gave an advanced market structure to map the true depiction of price movement , which consists of short term high/low , intermediate term high/low , long term high/low according to the trend.

We will discuss Highs first :

What Are Highs in Market Structure?

Short Term High ( STH )

Short term high is swing high consisting of three candles but middle candle should contain high wick from 1st and 3rd candle . It is like a normal swing high or low. Inner circle traders suggests price needs to go higher or lower by creating swing points. In an upward trend the swings point with three candles with middle wick high candle are called SHORT TERM HIGH or STH.

Long term High ( LTH )

These swings are STH until they get to a key level or High time frame PD Array. This could be a reversal area for a price so if price reverses from that KEY LEVEL by creating a break of structure, the last SHORT TERM HIGH or STH on a key level will become LONG TERM HIGH.

Intermediate Term high (ITH)

Intermediate term high is a middle swing point between two swings highs. The short term high turns into an immediate term high when two short term highs are created to its left and right. If a short term high is taken by another short term high (swing) and after sweeping high another swing high forms the middle short term high (swing ) which took high of previous short term high will become an intermediate term high ITH .

2ND WAY OF INTERMEDIATE CREATION ITH?

When price expands by creating FAIR VALUE gaps or inefficiencies , these gaps tend to fill eventually , so the swing point which rebalances the gap is also called an intermediate swing high.

According to ICT the intermediate term high or low ( according to the trend ) should be protected if the price is willing to move.

What Are Lows in Market Structure?

Short term lows STL:

Short term low is swing low consisting of three candles but middle candle should contain low wick from 1st and 3rd candle . It is like a normal swing low. Inner circle traders suggest price needs to go higher or lower by creating swing points. In a downward trend the swings point with three candles with a middle wick low candle are called SHORT TERM LOW or STL.

Long term Low ( LTL)

These swings are STL until they get to a key level or High time frame PD Array. This could be a reversal area for a price so if price reverses from that KEY LEVEL by creating a break of structure, the last SHORT TERM LOW or STL on a key level will become LONG TERM LOW.

Intermediate Term Low (ITL)

Intermediate term low is a middle swing point between two swings lows. The short term low turns into an intermediate term low when two short term lows are created to its left and right. If a short term low is taken by another short term low (swing) and after sweeping low another swing low forms the middle short term low (swing ) which took high of previous short term low will become an intermediate term low ITL.

Intermediate term low by Rebalancing Fair value gap