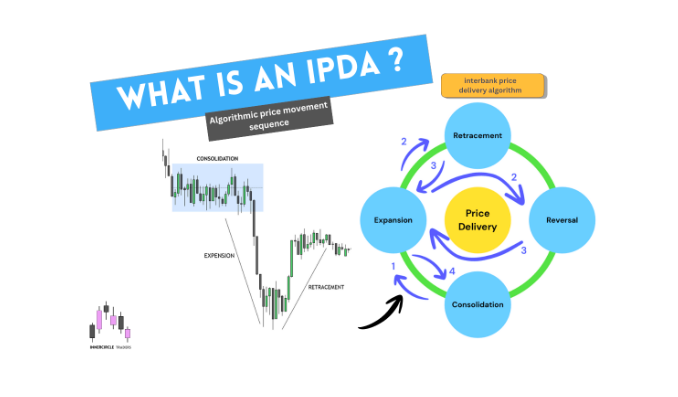

ICT PD ARRAYS stands for “ Premium and Discount Arrangements” . These are the key areas to get an entry from. Price does two things. It hunts liquidity and rebalance prices from premium to discount. PD arrays are like the bus stops traders use to get an entry from in order to ride with the ongoing trend.

WHICH PD ARRAYS MATTERS ?

TRADING RANGE :

In order to identify discounted or premium zones first we need to identify our trading range.Trading range is the recently price action in which we get recent old swing mark with Fibonacci tool from old swing high to old swing low.

This will give us a range with:

0

50%

100%

50% is the mid point of this price range . In a dealing range below 50% is a discounted zone and above 50% is a premium zone. ICT suggests if we are willing to buy , buy from the discounted zone and sell from the premium zone.

PD ARRAYS ARE THE SWEET SPOTS IN DEALING RANGES:

Once we know our DOL whether it’s bullish or bearish as we discussed in our previous articles in DRAW ON LIQUIDITY and ICT DAILY BIAS. Now we need to find PD ARRAYS to get our entry.

Here pd arrays will come to rescue us. PD Arrays are the key levels where price should get reverse from and continue going with ongoing trend on HIGH TIME FRAME.

If you want to know exactly when the London, New York, Tokyo, and Sydney sessions open in your local time, this Forex Market Hours tool makes it simple and accurate.

PD ARRAYS are like bus stops. Buses are running on roads with different routes. First a passenger needs to identify his/her destination then need to find the right bus and in order to get into the bus he/she needs to go to the bus stop in between he/she can never get into it Likewise, the pd arrays work like bus stops .

If we want to move with ongoing trend or move with prices we need to go into Right PD ARRAY in order to reach our destination (DRAW ON LIQUIDITY)

TYPES OF PD ARRAYS :

BULLISH PD ARRAYS :

PD ARRAYS are potentially used to get bullish or long entries. These should be available into our discounted zones.

BEARISH PD ARRAYS:

PD ARRAYS are potentially used to get bearish or short entries. These should be available into our premium zones.

NAMES OF SOME BULLISH PD ARRAYS :

ICT suggested many bullish pd arrays , if we have bullish bias on charts we need to find bullish pd arrays into our discounted zone. Here are some pd arrays list:

NOTE : In this article we are listing down only names of pd arrays in upcoming articles we will briefly discuss all of these pd arrays with implementation and examples.

- BULLISH ORDER BLOCK (OB)

- FAIR VALUE GAP (BISI)

- INVERSION FAIR VALUE GAP (IFVG)

- ICT BALANCE PRICE RANGE (BPR)

- ICT REJECTION BLOCK

- ICT BREAKER BLOCK

- MITIGATION BLOCK

- ICT REDELIVERED REBALANCE (RDRB

- NDOG

- NWOG

If any pd arrays or sometimes multiple pd arrays are present in the discounted zone , you can wait the price to retest into these pd arrays by getting into a low time frame. Take an entry. A real market example of a bullish PD array is shown in the picture below.

Proper risk management starts with position sizing. This Position Size Calculator helps you calculate the exact lot size based on your risk percentage and stop loss.

NAMES OF SOME BEARISH PD ARRAYS :

ICT suggested many bearish pd arrays , if we have bearish bias on charts we need to find bearish pd arrays into our premium zone. Here are some pd arrays list

- BEARISH ORDER BLOCK (OB)

- FAIR VALUE GAP (SIBI)

- INVERSION FAIR VALUE GAP (IFVG)

- ICT BALANCE PRICE RANGE (BPR)

- ICT REJECTION BLOCK

- ICT BREAKER BLOCK

- MITIGATION BLOCK

- ICT REDELIVERED REBALANCE (RDRB

- NDOG

- NWOG

Find these pd arrays into the premium zone , if these pd arrays are present into our premium zone we can find an entry by getting into a low time frame.

IDENTIFY TREND WITH PD ARRAYS | HOW CAN PD ARRAYS BE USED TO FIND OUR DIRECTION ?

PD ARRAYS are not only used to get an entry but also used to find our direction. In our previous articles or DRAW ON LIQUIDITY and ICT DAILY BIAS we already discussed how prices move from one pd array to other and from premium to discount zone.

Once a price has reached the High time frame PD ARRAY it can change its direction here PD ARRAY serves its real potential by giving us the next potential move and we know price direction is the most important element into our trading.

BULLISH PD ARRAY ON DAILY TIME FRAME

LOW TIME FRAME POSITION ALIGNMENT WITH HIGH TIME FRAME PD ARRAY:

WHAT NEXT IF PRICE REACHED INTO HIGH TIME FRAME PD ARRAY?

PD ARRAYS are also a key area. This area can be a turning point of price direction so we need to take pd arrays into consideration and wait for MARKET STRUCTURE SHIFT (MSS).

These liquidity pools act as magnets for price, providing clear targets. Before placing any trade, it’s important to understand currency values. This Currency Converter lets you quickly convert currencies using live exchange rates.

WHAT IS A MARKET STRUCTURE SHIFT (MSS):

Market structure shift is changing the direction of price movement when price reaches any KEY AREAS (PD ARRAY). Price moves by creating high and lows . This shift happens when price breaks its lows with intense magnitude called displacement.

In bullish market price moves by making higher highs and higher lows , MSS happens when price reaches a key level and instead of making another higher high its breaks its high low and is displaced with a big bearish candle below the recent swing low or high low created.

Likewise with bearish but MSS happens. In bearish price movement price moves lower low and lower high by reaching a key level price shifts by making higher high with displacement bullish candle.

NOTE : Market structure shift will be discussed in further articles along with CISD , UNICORN etc

If price reacts after reaching into PD ARRAYS and changes its structure into a low time frame we can anticipate a reversal.

Example:

If price has reached the premium zone and there is a HIGH TIME FRAME PD ARRAY present , price taps into the pd array and shifts its structure on a low time frame. Now we can make our BIAS from bullish to BEARISH.

FINAL THOUGHTS :

You should consider PD ARRAYS along with other ICT concepts with price movement context. No single concept can conclude the direction. Other factors like global environment and events matter.