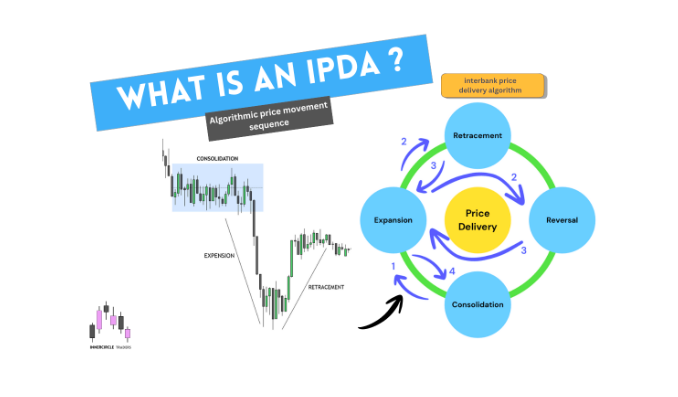

Liquidity is a money flow in the markets . All the open and pending orders present in a particular market is called liquidity. Liquidity is a burning fuel for markets.

For every buyer in a market there should be a seller to create equilibrium or fulfill orders. All retail traders and institutions’ orders are liquidity which fuel the price movement.

Why Does the Market Hunt Liquidity ?

Since we know liquidity is burning fuel for the market to move. When a trader puts on a trade and sets his Stop loss to a certain level , a point of liquidity is created.

Likewise hundred of thousands of orders placed at certain price levels or areas. In order to move prices, the market takes stops. To give buyers market hunt seller’s stops and vice versa. That’s a cycle of price movements in the market.

If you want to know exactly when the London, New York, Tokyo, and Sydney sessions open in your local time, this Forex Market Hours tool makes it simple and accurate.

Types of Liquidity :

Different types of liquidity in forms of pending orders and stops present in the market. Most common are:

- Previous Day High/Low

- Session bases liquidity

- Swing High / Low

- Equal High / Low

- FVGs

PREVIOUS DAY HIGH / LOW:

Previous day highs and lows are the most vulnerable areas for prices to revisit and stop out or hunt liquidity.Market needs to rebalance the buyers and sellers every time to move prices between certain price levels for a specific period of time.

When the market closes the previous day low and high become the most vulnerable area to hunt. Algorithms are designed to hunt for stop orders on both sides of the market.

So price hunt and stop out orders placed the low/ high on the previous day swing low/high.

Proper risk management starts with position sizing. This Position Size Calculator helps you calculate the exact lot size based on your risk percentage and stop loss.

Hint : Plan your entries after taking the previous day high low are the high probability setups.

SESSION BASES LIQUIDITY:

As we are aware of , the trading day consists of three MARKET SESSIONS (I considered sydney and tokyo same ) . Generally one out of three sessions consolidates and the rest of two moves according to DAILY BIAS.

When a new session opens the Algorithms are instructed to hunt Above/ below liquidity of the previous session. For example Asian sessions usually generate a range of liquidity for the LONDON session open and hunt to move prices.

Likewise above below London session liquidity is accumulated for NEW YORK sessions to hunt so on and so forth. This liquidity is called session based liquidity.

SWINGS HIGH AND LOW:

Price does not move in straight lines, instead they make highs and lows. Every high and low is called a swing high or swing low ( should consist of three candles with middle lower or higher ).

There is a major amount of liquidity present below / above swing high / swing low. Generally when we put on a trade we put our stop below or above swing high/low according to our direction.

Similarly hundred of thousand traders put their stops above/below swing high /low so massive amounts of liquidity presents there to hunt for markets.

Before placing any trade, it’s important to understand currency values. This Currency Converter lets you quickly convert currencies using live exchange rates.

EQUAL HIGHS AND EQUAL LOWS:

When two swings high/low are created relatively equal or totally equal to each other these equal swings are called equal swing high/low. Market hunt these equal highs/lows.

For retail traders these multiple rejected swings are resisted areas for price to break but these equal high/low are traps created by Market makers to accumulate liquidity above/below these areas . Retailers put their stops and become liquidity for Market makers.

INEFFICIENCIES OR GAPS ( FVG ):

Liquidity is an area in the market where prices are to revisit to trade again. When prices drop or climb sharply from any level, inefficiencies are gaps.

These are voids and gaps which are needed to revisit for price to fill or rebalance. Since prices are to revisit the certain areas in the form of inefficiencies this is a highly liquid area in the market. The volume of orders surge in the area.

HOW TO SPOT LIQUIDITY ?

Since we know either spot the liquidity or become a liquidity. So spotting liquidity in the market provides high probability setups to trade. All above discussed areas are high volatile or liquid areas for the market to hunt.

LOW RESISTANCE LIQUIDITY RUN ( ICT CALLED IT LRLR ):

Low resistance run liquidity are the failure swings in the price legs. When price continuously makes high or lows without sweeping previous lows or without creating inefficiencies (FVG) these legs generate low resistance liquidity run which works burning fuel for prices to hunt later.

This is the easiest and quick target for price to meet or hunt. Generally these legs are created when prices are to push back into any High time frame PD ARY (which will be discussed in further chapters) or key level from which prices are to get reversed from and hunt these failure swings. ICT called this cutting butter with a hot knife.

Hint : Plan your entries from High time frame key levels and target LRLR for quick targets.

HIGH RESISTANCE LIQUIDITY RUN:

In the contract to low resistance liquidity run , high resistance liquidity is liquidity below HTF PD ARY or key level . Price can not take this liquidity easily since a hurdle comes in the way.

When we put on a trade and a high time frame pd ary spot in the opposite which creates resistance to deliver for price. This is a high resistance liquidity.

Generally we should avoid this type of entries because high resistance liquidity does not permit prices to meet our target which is beyond high resistance liquidity. High resistance liquidity can be a FVG , or Order block in an opposite leg.

HOW TO TRADE LIQUIDITY ? (WICK DO THE DAMAGE AND BODIES TELL THE STORY)

Trading liquidity starts with spotting liquidity on the charts. Move without liquidity hunt is usually a trap for traders so let the market hunt available liquidity or stops then execute your entries.

Target opposite liquidity for target. LRLR is the sweet spot to target.

So wait for liquidity sweep first

Liquidity Sweep:

There is a saying by ICT ,” wick do the damage and bodies tell the story “. Price hunts liquidity and closes its body inside range indicating its intention to move to the opposite side.

When price takes stop orders with a large candle and after hunting stop orders closes inside again is called LIQUIDITY SWEEP. This is the first sign or indication for traders of price movement.