Since we know the price moves to hunt liquidity. Liquidity is a burning fuel for prices.ICT gives liquidity concepts and explains internal and external liquidity.

Why Does the Price Move?

Price moves for the sake of

- Hunting liquidity

- To fill fair value gaps ( FVG )

ICT DEALING RANGES : SWING HIGH AND SWING LOW

Market makers move prices between two ranges within a certain period of time. The ranges are swing points the higher and the lower, between these two points the swings and fair value gaps are created . These are internal range and external range liquidity.

These two swing points are strong resistance and support zones or KEY LEVELS. Price more often visits these points.

If you want to know exactly when the London, New York, Tokyo, and Sydney sessions open in your local time, this Forex Market Hours tool makes it simple and accurate.

EQUILIBRIUM OR 50 % OF THE RANGE :

Equilibrium is the half or 50% level of any dealing range. This is meant to be the level where buyers and sellers are not dominating each other and the prices are equal neither at premium nor discount. ICT suggests if bullish wait for price to trade on equilibrium level for buy or sell when bearish. Above 50% prices are at premium and below 50% prices are discounted.

INTERNAL RANGE LIQUIDITY : (IRL)

Internal range liquidity is the liquidity that lies inside or defined swing high and swing low. When we refer to internal range liquidity we usually refer to FAIR VALUE GAPS as internal liquidity.

Price does two things or moves only to fill FVG ( mean threshold area of FVG ) and to hunt orders above or below swing high or swings low. ICT FAIR VALUE GAP (FVG)is the liquidity because it is a formation of three candles leaving an area between high and low of 1st and 3rd candle where price did not overlap.

So this area is sensitive (especially the mean threshold of FVG ) for price to revisit to fill the gap. This vulnerability makes this area internal range liquidity.

When price moves to balance the fair value gap it basically sweeps the liquidity in lower timeframes.

EXTERNAL RANGE LIQUIDITY:

An external range liquidity is the buy and sell stops above or below swing points or dealing ranges. This is buy side and sell side liquidity. Traders put their stops and their limit orders above and below these swing points so these liquidity areas are vulnerable for price to hunt.

When prices tap into FAIR VALUE AREA and get rejected from FVG taking liquidity swept on lower time frames , price expands from IRL towards ERL.

The high of an ICT dealing range is termed as “buy side liquidity” assuming the buy stops resting above the high of the dealing range.

While the low of an ICT dealing range is known as “sell side liquidity” assuming the sell stops resting below the low of dealing range.

Proper risk management starts with position sizing. This Position Size Calculator helps you calculate the exact lot size based on your risk percentage and stop loss.

USE OF IRL IN BUILDING YOUR BIAS (DIRECTION) :

Daily Bias is the potential planning of your daily expected direction. (will discuss in detail about DAILY BIAS ). For traders establishing your DAILY BIAS is a core step in trade planning. Since we know price does two things. Price moves from IRL (internal range liquidity) to ERL(external range liquidity).

If price has just taken ERL by creating FAIR VALUE GAPS we can anticipate that price has to make retracement to fill the GAPS which is an internal range liquidity.

Which time frame is essential for marking an IRL ?

ICT gave a concept of “TIME FRACTIBILITY”. Each time frame is a depiction of price movement at real time. So this internal range liquidity phenomena is fractile. We can see this phenomena of price movement in every time frame. Price moves from IRL to ERL and from ERL to IRL. This is an ongoing concept in the market.

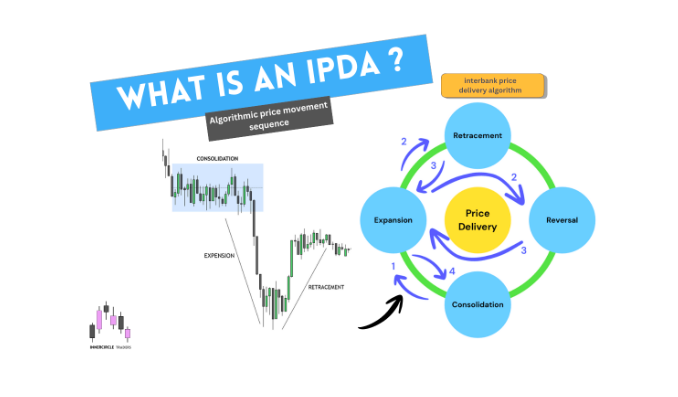

IRL TO ERL AND ERL TO IRL ( PRICE MOVEMENT CYCLE )

After discussing dealing range and internal range liquidity and external range liquidity now we are going to discuss the price movement cycle. They usually move from IRL to ERL and from ERL to IRL.

Price moves by algorithms and these algo move prices from INTERNAL TO EXTERNAL and vice versa. Price moves from FVG’s towards SWING LOW/HIGH (according to the direction) and from SWING LOW/HIGH to FVG’s.

Before placing any trade, it’s important to understand currency values. This Currency Converter lets you quickly convert currencies using live exchange rates.

What are the EXCEPTIONS?

An idea of price movement between IRL and ERL is an assumption that the market tends to fill liquidity gaps and fill FVG. we can not solely depend on or predict the movement with only this indicator or tool. Other price movement measures need to be considered. The context of the market is important to consider.