ICT daily bias is the method of predicting the next move of the price or predicting the direction of price movement on a certain day of the week. ICT suggest daily bias is one of the fundamental aspect of Trading.

What is a Daily Bias?

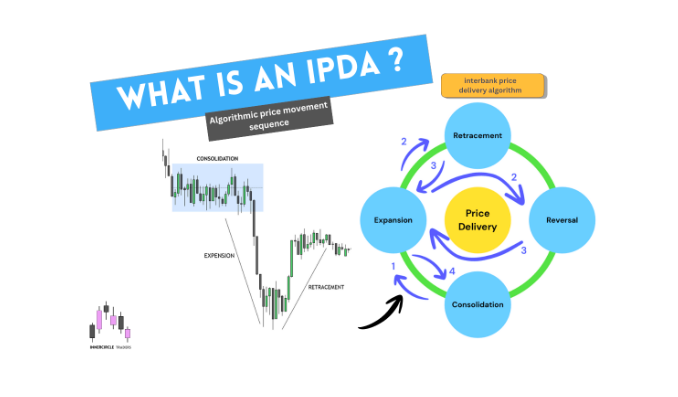

Prices move from one direction to another on charts. Price is directed by algorithms through a certain set of instructions but the object is to hunt liquidity. Daily Bias is a direction of the market or trend of the market on a certain day of week. Daily Bias is the prediction of prices from a certain level up to a certain level , bullish or bearish on a specific day of the week.

Why does Daily Bias matter ?

ICT suggests finding out the direction of the market is one of the important steps for a trader. If a trader learns to find the direction of price then executing is pretty much easy. ICT suggests taking entry on a low time frame is the least difficult thing a trader has to go through. Daily bias is important

If you want to know exactly when the London, New York, Tokyo, and Sydney sessions open in your local time, this Forex Market Hours tool makes it simple and accurate.

1: To escape from judas move (Market makers trap/false breakout) :

Market makers make fake swings points or liquidity levels to bait the retail traders. These moves usually trap the traders and make them caught in judas moves (fake moves) but when a trader identifies the real move of prices with Daily Bias , a trader can predefine the opposite fake moves and align their positions in the true direction of the market.

2: To drive through the trend:

Trend is your friends, this is saying in the markets. Trend is a flow of prices a trader should flow with not opposite to the trend so Daily bias helps to find out the trend on a specific day so traders can escape unnecessary losses and make their direction with market makers.

HOW TO FIND A DAILY BIAS?

To identify or find out Daily Bias a trader needs to check these elements

Why does a price move ?

To hunt liquidity

Order flow mapping

To rebalance fair value gaps (FVGs)

From premium to discount

Proper risk management starts with position sizing. This Position Size Calculator helps you calculate the exact lot size based on your risk percentage and stop loss.

To Hunt Liquidity :

Liquidity is a burning fuel for prices , we discuss liquidity in previous articles. Liquidity levels are the sweet spots for prices to hunt or visit.

Daily bias can determine after locating a liquidity levels (we discussed in detail in previous article) a trader can anticipate the market will eventually visit these levels so a trader has to find out liquidity levels , spots to find Daily Bais and align with these levels with other factors ( context )

To rebalance fair value gaps (FVGs):

Fair value gaps are also liquidity areas( internal liquidity ) where a price should revisit to fill or rebalance. So it is a vulnerable area for price to revisit. This phenomena helps a trader to find out Daily Bias or direction of market.

These liquidity pools act as magnets for price, providing clear targets. Before placing any trade, it’s important to understand currency values. This Currency Converter lets you quickly convert currencies using live exchange rates.

IRL-ERL : we discussed in the previous article , price follows most of the time this pattern , IRL to ERL. After taking out liquidity from swings, price usually goes to fill the FVGs or fair value areas.This will help traders to find the next move the market is likely to make.

From Premium to Discount levels:

Price does not make highs aggressively nor makes lows but makes retracements. Retracements are the corrections the market makes after making an impulse move high or low. These retracements can vary on their sizes,

Minor Retracement

Deep Retracement

When prices are aggressively bullish or bearish it does not take deep retracement , premium and discount are the 50% level of any price leg (price leg contains swing high , swing low and fvg inside).

This premium and discount phenomena helps a trader to predict the next move or daily bias. When prices are bullish mark 50% level of last price leg , a price can take retracement up to 50% this helps to predict the move.

Above 50% premium

Below 50% discount

Hint : Buy from discount sell from premium level

Order flow legs:

Order flow leg should consist of three things: a swing high , a swing low , a fair value gap. When prices are in trend it offers order flow legs , price expands its legs by offering fair value gaps.

These order flow legs help traders to find out the strength of ongoing trends which eventually helps in finding Daily Bias.

Draw on liquidity for Daily Bias :

In a previous article we discussed Draw on liquidity , These are the most obvious liquidity levels a price should take. These can help to predict price direction.

These draw on liquidity can be swing high or swing low, equal highs and lows on charts , smooth levels on charts. Fair value gaps, LRLR low resistance liquidity run , swings failure all these areas are the most vulnerable areas price should visit so this concept (Draw on liquidity) helps a trader to find out Daily Bias

Which time frame is essential to find Daily Bias?

ICT suggested our first duty is to predict where the daily candle is going to or how it is going to develop. So according to the ICT daily time frame it is fundamentally important to find out the next daily candle prediction. ICT also suggested Big players and institutions trades on a daily time frame so we need to make our Daily Bias on daily time frame.

What after finding Daily Bias (Taking position)?

After finding out the Daily Bias we need to find out PD ARRAYS or KEY LEVELS (will discuss in depth in upcoming article) which can be

FVG

ORDER BLOCK

BREAKER BLOCK

IFVG

MITIGATION BLOCK

ICT RDRB

NOTE: All above pd arrays will be discussed in upcoming articles.

Any many more pd arrays , wait price to tap onto your existing pd arrays which aligns with your DAILY BIAS , when a price tap onto your pd array drops down into a lower time frame (will discuss time frame alignment in upcoming articles) . wait for low time frame confirmation and execute your entry.

Final Thoughts:

To find out precise Daily Bias you have to align these concepts with other context like , ICT Power of 3 or AMD make conjunction with draw on liquidity and inefficiencies with time fractability.