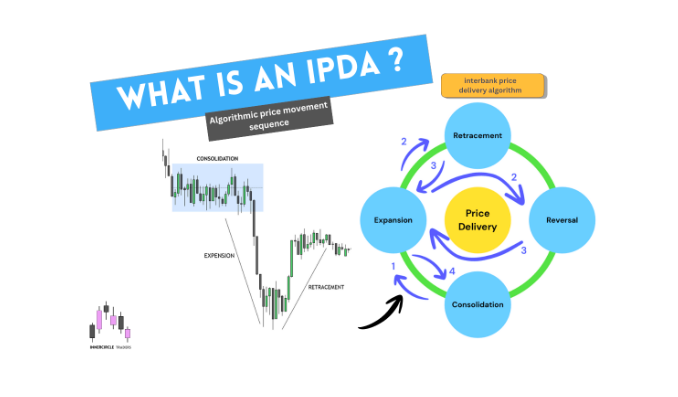

ICT (inner circle trader) gave the concept of power of three or AMD to understand the price movement phases. Prices move through these three phases.

Since we know candles are depictions of prices printed on charts , If we elaborate the autonomy of candle creation , each candle prints with AMD phenomena. Power of three consist of open price of candle , high / low (bullish or bearish scenario ) close.

Since time is fractal, we can see this phenomenon in all time frames. It does not matter which time frame you are looking or trading each time frame candle print through this AMD or PO3 phenomena.

If you want to know exactly when the London, New York, Tokyo, and Sydney sessions open in your local time, this Forex Market Hours tool makes it simple and accurate.

Autonomy of Bullish Candle

Autonomy of Bearish Candle

Prices move from one point to another by adopting the AMD pattern.

By understanding these 3 phases, a trader can avoid traps, and trade alongside market movers to maximize profits and minimize losses.

WHAT is an ICT POWER OF 3 or AMD ?

ICT gave the power of three to crack the trap of big players in the market. Once we identify the trap (manipulation) we can minimize our losing and maximize our winning.

Accumulation phase:

Smart money needs liquidity to fulfil their orders and to move the prices , so they need to lure traders by creating fake support or resistance zones.

Accumulation is the starting phase of any movement. When price is trading between two tight ranges and price is not willing to leave the zone called Accumulation phase.

If we look through the lens of a High time frame candle this is an opening of a high time frame candle. Since time is fractal on a lower time frame the price is ranging or accumulating.

Proper risk management starts with position sizing. This Position Size Calculator helps you calculate the exact lot size based on your risk percentage and stop loss.

Manipulation phase :

After accumulating the orders of retail traders price moves to the opposite true directions. This is manipulation. Smart money creates fake moves to stop out retail traders , hunt the liquidity.

After accumulation smart money moves the market in the opposite direction like on bearish day, they manipulate the retailer traders toward buy-side.

While on bullish day they manipulate toward the sell-side. Smart money makes fake breakout by running price above or below the accumulation phase.

Retailers put their orders or limit orders on both sides of ranges so Smart money manipulates prices first toward one side to wipe out or triggers their orders then towards the other side to wipe out and triggers their orders. By doing so Smart money accumulates money to fulfil their desired volume of order.

Hint : A trader can save losses and align his trade direction by spotting the Manipulation.

Distribution phase:

This is the real move. After accumulating and hunting stops Smart money needs to move prices toward the true direction. When distribution occurs we can see big candles or volatility in the markets.

Traders can gain by following the path of smart money. The volume of trading surges massively during the distribution phase.

AMD EXAMPLE WITH DIAGRAMS :

Power of Three in Bullish Markets:

Power of three works perfectly on bullish and bearish markets. On a bullish day price should accumulate near open price. Smart money creates range before manipulation.

When price accumulates, retail traders trap by the fake range created, strong support to buy or strong resistance to sell. They put their orders or set their limits. Liquidity generates near open price or accumulation area.

When orders are accumulated Smart money triggers the manipulation phase. Prices move in the opposite direction. Retailers find this break out and they put more orders.

After triggering orders Smart money reverses the prices from any KEY LEVEL ( will be discussed in upcoming articles). Smart money moves prices to the discounted area of the market and starts buying from the discounted zone.

After hunting liquidity or stopping the retailer’s orders. price starts to distribute towards the bullish direction.

Example :

Power of Three in Bearish Markets :

On a bearish day, prices should accumulate near open prices. Smart money creates range before manipulation. When price accumulates, retail traders trap by a fake range created , strong support to buy or strong resistance to sell.

They put their orders or set their limits. Liquidity generates near open price or accumulation area. When orders are accumulated Smart money triggers the manipulation phase.

Prices move in the opposite direction. Retailers find this break out and they put more orders. After triggering orders Smart money reverses the prices from any KEY LEVEL ( will be discussed in upcoming articles).

Smart money moves prices to the premium price area of the market and starts selling from the premium zone. After hunting liquidity or stopping the retailers price starts to move bearish.

Before placing any trade, it’s important to understand currency values. This Currency Converter lets you quickly convert currencies using live exchange rates.

Example :

How to trade AMD or Power of Three ?

Power of three is essential to trade into smart money direction or to get safe from traps created by smart money in the market. You need to develop your DAILY BIAS correctly in order to trade true market direction.

Daily Bias is the direction of a market on a daily basis. You need to predict the daily candle’s direction. Once you predict the direction, be patient and let the market accumulate or consolidate.

Wait patiently to break out the range. After accumulation the smart money traps traders by manipulating the price to the opposite direction. Don’t get trapped once you are confident with your daily candle’s direction.

Let the price hunt orders and tap on any key level. Go into a lower time frame and watch the price movement closely. When the price starts to reverse with movement or displacement place your order and ride with SMART MONEY.

Why does Price Do That ?

Accumulation phase : to engage impatience traders.

Manipulation phase : to trigger emotions of traders by hunting orders and moving prices to opposite directions.

Distribution phase : real move to make money or take price to a certain level/area.

Which Phase to Trade ?

Accumulation and manipulation are not for trade, instead these phases are for aligning yourself with the direction of smart money. Don’t get trapped with manipulation.

Wait patiently for your lower time frame confirmation. Always trade the Distribution phase. Accumulation and manipulation are not advised to trade.