Who is SMART MONEY IN FINANCIAL MARKETS?

Smart money are the institutions with massive trading transactions that bring volatility in the markets. They can literally divert price direction and movement.

They are like big sharks in the tank. They need stop order / liquidity to fulfill their massive orders.

They have massive orders and to fulfill their orders they need equal buyer or seller (liquidity) to meet their orders so.

If you want to know exactly when the London, New York, Tokyo, and Sydney sessions open in your local time, this Forex Market Hours tool makes it simple and accurate.

What do Smart Money do?

They lure retail traders by creating fake moves in the markets by creating opposite desired moves . Retail traders find themselves in a dilemma. They go after fake moves to catch reversal but they STOPOUT by SMART MONEY. ICT called this “Turtle soup”

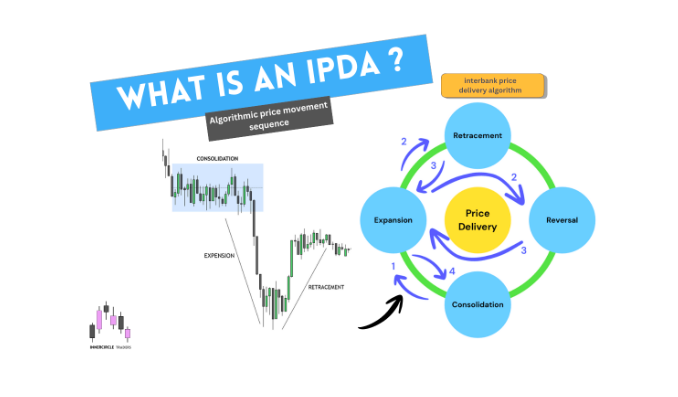

MARKET EFFICIENCY PARADIGM

Markets are running with liquidity (orders from retail traders or institutions). Big institutions are like wheel pullers. SMART MONEY drives prices from one direction to another. They move prices to fill inefficiencies and hunt stop orders. The market is balanced with SMART MONEY and Uninformed money ( RETAILERS).

Markets are running with liquidity (orders from retail traders or institutions). Big institutions are like wheel pullers. SMART MONEY drives prices from one direction to another. They move prices to fill inefficiencies and hunt stop orders. The market is balanced with SMART MONEY and Uninformed money ( RETAILERS).

HINT: IDENTIFY LIQUIDITY OR BECOME LIQUIDITY BE AWARE .

Proper risk management starts with position sizing. This Position Size Calculator helps you calculate the exact lot size based on your risk percentage and stop loss.

How do we know this move is driven by SMART MONEY in the true direction ?

Once bulk orders from retails traders are out by fake moves created by SMART MONEY prices tend to move towards true directions. Price moves after hunting liquidity or stop losses of retail traders.

When smart money is involved in moving big BULLISH/BEARISH (according to trend) candles start to emerge on charts. ICT Concept called these candles DISPLACEMENT. We can clearly see volume spikes when these big candles start to print on charts.

DISPLACEMENT :

After hunting stop orders SMART MONEY drives prices towards their direction sharply. Prices are displaced with massive sharp candles called displacement. Displacement shows the intention of price to move.

HOW CAN WE MASTER SMART MONEY TRAP?

Once we know where the retail traders are getting trapped by fake moves we can position ourselves in order to catch the moves driven by Big institutions or SMART MONEY.

Before placing any trade, it’s important to understand currency values. This Currency Converter lets you quickly convert currencies using live exchange rates.

Identify where the liquidity resides , where the majority of stop loss resides. Think with retails logic in order to look where the retailers are likely to hunt by SMART MONEY.

Let them stop hunting . let the most of retailers wipe out by fake move or fake break out wait for DISPLACEMENT (true intention of big players) then place your orders. Drive with SMART MONEY.

HINT : PLAN YOUR POSITION OR TAKE YOUR ENTRIES AFTER HUNTING LIQUIDITY