Inner circle trader known ICT named “Micheal J Huddleston” is well known trader , influencer , teacher who’s work in SMC concepts is tremendous. Traders all around the world in the Trading industry using his concepts. ICT or inner circle trading is mainly focused on TIME AND PRICE.

TIME IS FRACTAL :

This is the core concept of ICT teaching. Time is fractal. The market prints candles with the same autonomy on all time frames. Same logic things print on Monthly time frame , Daily time frame even on 1 minute time frame.

Swing high , swing lows , breaker each concept works simultaneously on all time frames which show the fractability of the market. Prices move with the same logic on all time frames but take time according to time frames.

If you want to know exactly when the London, New York, Tokyo, and Sydney sessions open in your local time, this Forex Market Hours tool makes it simple and accurate.

Here is an example of FRACTABILITY OF TIME

BREAKER AND SWING HIGH LOW ON MONTHLY TIME FRAME

BREAKER AND SWING HIGH LOW ON 1 MINUTE TIME FRAME

In this example price created swing low / swing high and breaker block with same logic and autonomy but vast difference of time between two examples.

TIME IS MORE IMPORTANT THAN PRICE:

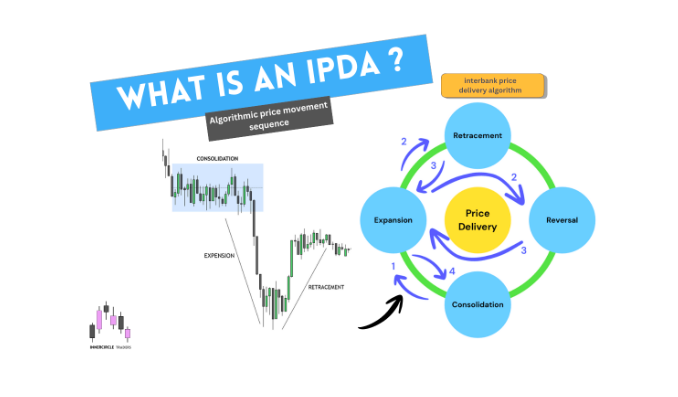

Time is the most important element in price movement. Markets are not random nor do they move randomly or just buying and selling pressure ( according to ICT ).

Markets are controlled through Algorithms. These computer program coded algorithms run prices in very specific time zones.

Proper risk management starts with position sizing. This Position Size Calculator helps you calculate the exact lot size based on your risk percentage and stop loss.

MIDNIGHT OPEN PRICE (TRUE DAY OPEN):

Since time is the most important element in trading or price movement according to ICT, Algorithms are active from 12 AM ( UTC-4 NEW YORK Local Time) .

ICT traders are advised to set their computer or whatever devices they are using for Trading to UTC-4 (NEW YORK ) Time zone. This is the time when our TRUE DAY opens.

MIDNIGHT OPEN PRICE WHEN WE ARE BULLISH ON INTRADAY:

Midnight open price is a gauge to measure our premium discount price. If our daily bias is bullish ( we will further discuss in details about DAILY BIAS) we should mark midnight open price on our charts with annotations of 00:00 /12 AM .

If we are Bullish ideally we should find an entry below MIDNIGHT OPEN PRICE. Look at the chart example of EURUSD below.

EUR/USD

MIDNIGHT OPEN PRICE WHEN WE ARE BEARISH ON INTRADAY :

Like wise if our Daily bias is bearish. We should find a sell entry above MIDNIGHT OPEN PRICE.

Look at the chat example of EURUSD below.

ICT KILLZONES : TIME BASED FACTOR IN PRICE MOVEMENT

Killzones are specific time windows of each session in which markets become rapid or volatile. In simple words, movement in price becomes fast.

The algorithms are designed to run prices so they move prices in very specific time zones. Big institution trade during these time windows also makes them volatile.

We as a trader need to find an opportunity of trade where we find liquidity or price movement so Killzones are the time window we need to plan our entries.

Before placing any trade, it’s important to understand currency values. This Currency Converter lets you quickly convert currencies using live exchange rates.

There are four ICT kill zones time window:

- ASIAN KILLZONE

- LONDON OPEN KILLZONE

- LONDON CLOSE KILLZONE

- NEWYORK KILLZONE

| Killzone | Time (EST/EDT) | Purpose / What ICT Looks For |

| Asian Session Range | 6:00 PM – 12:00 AM | Market sets the range for next-day liquidity grabs. |

| London Open Killzone (LOKZ) | 2:00 AM – 5:00 AM | Volatility expansion begins; liquidity grabs; Judas swing. |

| London Close Killzone (LCKZ) | 9:30 AM – 11:30 AM | Reversals common; profit-taking phase. |

| New York AM Killzone (NY AM KZ) | 7:00 AM – 10:00 AM | Heavy displacement; news events; best setups for indices & FX. |

WHICH TIME ZONE IS FOR WHICH PAIR ?

Let’s find out which time zone is best for which pair.

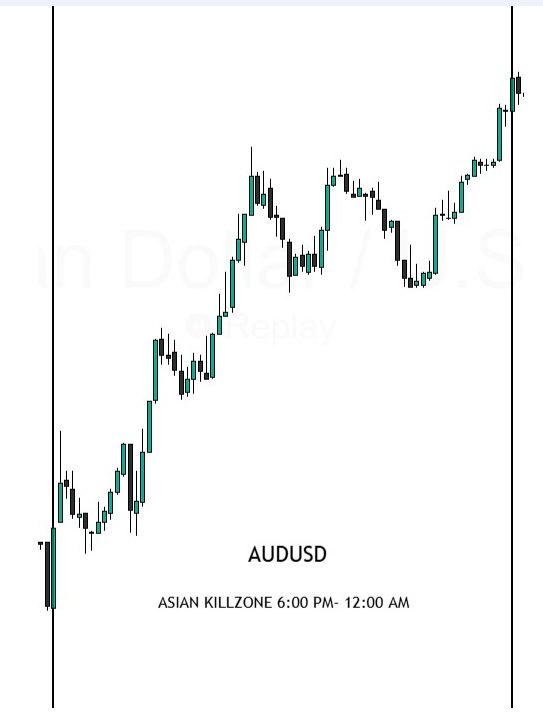

ASIAN KILLZONE:

For Asian , Australian , New Zealand dollar correlated pairs , trading volume surges during Asian killzone.

AUDUSD CHART:

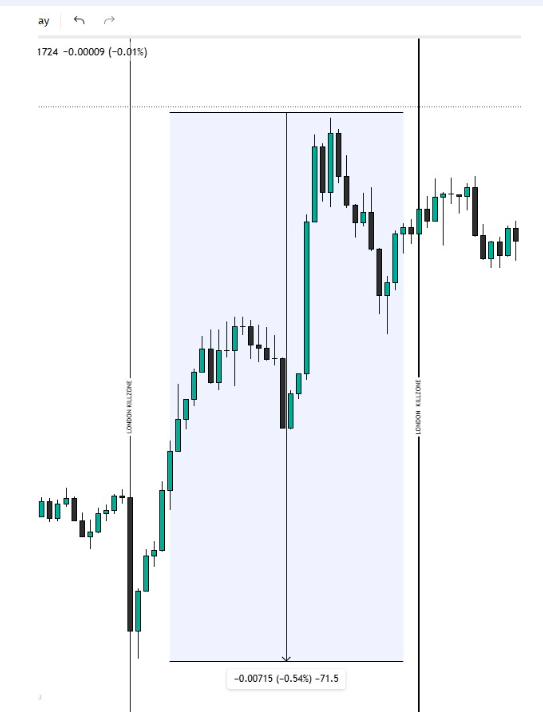

LONDON OPEN AND CLOSE KILLZONE:

For all Major currencies and indices . london killzone overlaps with the new york session which brings much volatility. EURUSD, GBPUSD , NASDAQ , GOLD etc are volatile in this time window.

GBPUSD (moved 72 pips during london killzone)

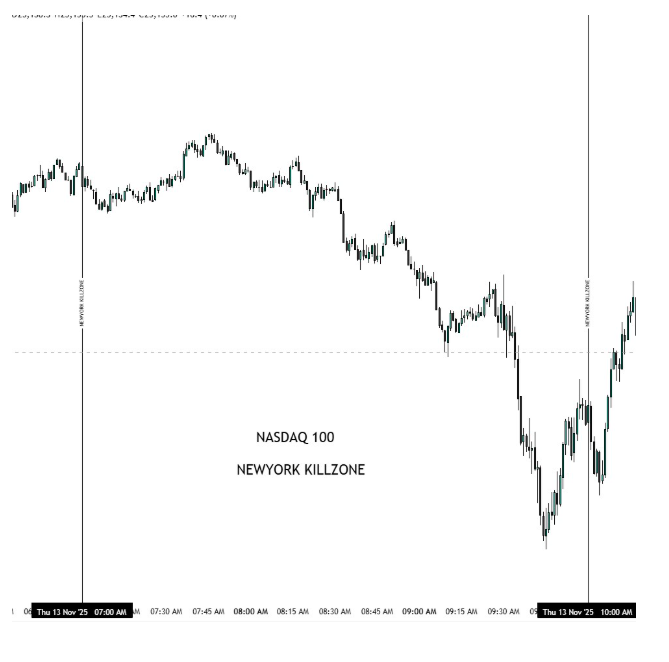

NEW YORK KILLZONE:

For all Major currencies and indices . london killzone overlaps with the new york session which brings much volatility. EURUSD, GBPUSD , NASDAQ , GOLD etc are volatile in this time window.

NASDAQ 100

What is SILVER BULLET in ICT Concept?

What is SILVER BULLET in ICT Concept?

Like killzones ICT SILVER BULLET is a 1 hour specific time window that brings much volatility in price. Price hunt liquidity and meet Draw on liquidity ( Targets) within these 1 hour time zones. ICT traders make specific trading strategies by utilizing these time zones.

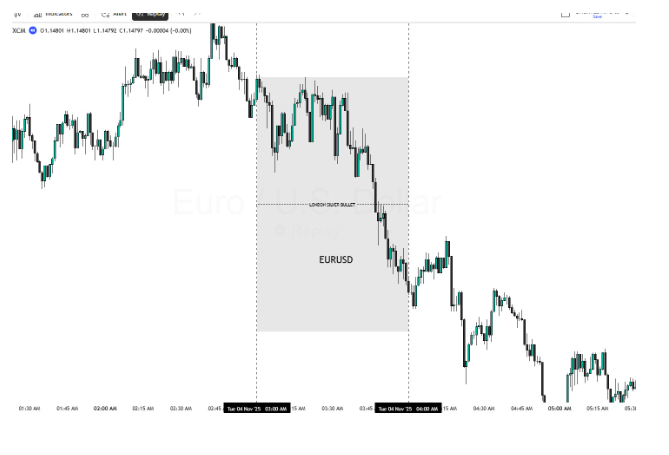

LONDON OPEN SILVER BULLET : (3 AM – 4AM)

London open silver bullet is 1 hour, the most volatile time window starts with the opening of the London session. 3AM to 4AM (NEW YORK TIME ZONE) The price usually expands during this time window. Usually provide trading opportunities in this 1 hour time window.

EURUSD

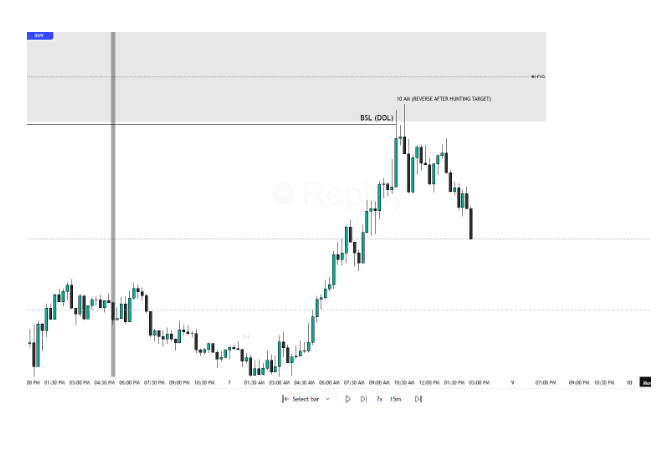

NEW YORK SILVER BULLET : (10 AM – 11 AM)

Likewise London Silver Bullet , New York session also provides silver bullet opportunities between 10 AM – 11 AM. This is the time when price most likely expands to meet its target (DOL) but if intraday target is achieved during London or New York opening then 10 AM silver bullet most likely can reverse prices (intraday).

NEW YORK SILVER BULLET REVERSAL

4H FVG was DOL ( Target ) price gets reversed at 10AM silver bullet after getting intraday target.

MACRO TIMING :

MACRO TIMING :

This is a 20 minute time window ICT gives for a quick scalp. Macro starts 10 minutes before new hours and lasts 10 minutes after new hours.

Here are some examples of Macro Timing:

9:50 – 10:10

10:50- 11:10

NOTE: ALL DISCUSED BRIEFLY ABOUT TIME ELEMENT IN MARKETS WILL DISCUSS KILLZONES AND THEIR CHARACTERISTICS FURTHER.